The question of whether churches are public property is a complex one that has been debated for centuries. At first glance, it seems straightforward: churches are religious institutions, and religion is a private matter. However, the reality is far more nuanced. While churches are generally considered private entities, they often interact with the public in significant ways and may receive government funding or tax benefits. Understanding the legal status of churches requires careful consideration of these various factors.

This article will delve into the intricate world of church law, exploring the different perspectives on whether churches are public property. We’ll examine the arguments for and against this classification, considering the role of churches as private entities, their public interactions, government support, and legal variations across jurisdictions. By the end, you’ll have a clearer understanding of the complex legal landscape surrounding churches and their relationship with the public sphere.

Church as Private Entity

One of the primary arguments for classifying churches as private property stems from their fundamental nature as religious organizations. Churches are typically established by individuals or groups who share common beliefs and practices. They operate independently of government control, setting their own doctrines, conducting their own services, and governing themselves internally. This autonomy aligns with the principle of religious freedom enshrined in many constitutions worldwide.

Furthermore, churches often function as private businesses, managing their finances, property, and personnel according to their internal rules and regulations. They may own buildings, land, and other assets, which are considered private property under most legal systems. Churches also engage in fundraising activities, relying on donations from members and the wider community to support their operations. This financial independence reinforces their status as private entities separate from government control.

Public Interaction of Churches

Despite their private nature, churches frequently interact with the public in various ways. They offer religious services open to anyone, regardless of their faith or background. Many churches also engage in social outreach programs, providing food banks, shelters, and other essential services to those in need. These activities demonstrate a commitment to serving the community and addressing public concerns.

Churches often serve as gathering places for social events, celebrations, and community meetings. They may host concerts, plays, or educational workshops open to the public. This active participation in public life further blurs the lines between private and public spheres. Moreover, churches frequently engage with local government on issues affecting their communities, advocating for policies that align with their values and beliefs.

Government Funding and Tax Benefits

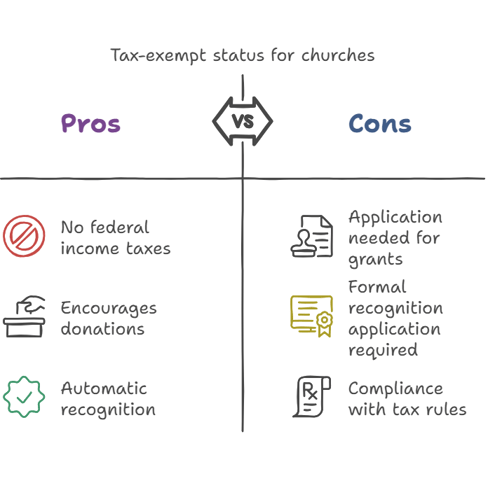

The relationship between churches and government funding is a particularly contentious issue. While churches are generally prohibited from receiving direct government funding for religious activities, they may be eligible for certain grants or subsidies for social programs they operate. This raises questions about the extent to which government support should extend to religious institutions.

Churches also benefit from tax exemptions, which allow them to avoid paying property taxes and income taxes on their earnings. These exemptions are often justified as a way to encourage charitable activities and promote religious freedom. However, critics argue that these benefits give churches an unfair advantage over other non-profit organizations and may lead to government entanglement in religious affairs.

Legal Status by Jurisdiction

The legal status of churches can vary significantly depending on the jurisdiction. Some countries have strict separation of church and state, while others have a more integrated relationship between religion and government. In some cases, churches are recognized as public institutions with certain legal rights and responsibilities. In other cases, they are treated primarily as private entities subject to less stringent regulations.

For example, in the United States, the First Amendment guarantees freedom of religion and prohibits the establishment of a state religion. This principle has been interpreted to protect churches from government interference in their religious practices. However, it does not preclude all forms of government interaction with churches. The legal status of are churches public property remains a subject of ongoing debate and litigation in the US.

Church Operations and Law

Churches are generally expected to comply with applicable laws and regulations, even though they enjoy certain exemptions. This includes adhering to building codes, zoning ordinances, and labor laws. Churches may also be subject to specific legal requirements related to their charitable activities or fundraising practices.

Furthermore, churches can face legal challenges if their actions violate the rights of others. For example, a church that discriminates against individuals based on race, religion, or sexual orientation could face legal action. Similarly, a church that engages in illegal activities, such as fraud or tax evasion, would be subject to prosecution.

Conclusion

The question of whether churches are public property is complex and multifaceted. While they are primarily considered private entities due to their religious nature and autonomy, churches often interact with the public, receive government support, and operate within a legal framework. The specific legal status of are churches public property varies depending on jurisdiction and how churches function. Ultimately, understanding this intricate relationship requires careful consideration of the various factors involved, including religious freedom, public service, government funding, and legal regulations.