Navigating life without a permanent address presents numerous challenges, and securing auto insurance for homeless individuals can feel like an insurmountable hurdle. Traditional insurers often rely on fixed addresses for verification purposes, leaving many without access to essential coverage. However, don’t despair! While the process may require extra effort, obtaining auto insurance for homeless individuals is possible with thorough research and creative solutions. This article will delve into the complexities of this situation, explore specialized insurance providers, and discuss temporary address options that can pave the way to securing the necessary coverage.

This comprehensive guide will first examine the unique challenges faced by homeless individuals seeking auto insurance. We’ll then introduce specialized insurance providers who cater to their specific needs. Next, we’ll explore various temporary address solutions that can help overcome traditional insurer requirements. Finally, we’ll emphasize the crucial importance of auto insurance for everyone, regardless of their housing situation.

Auto Insurance for Homeless Individuals

The fundamental purpose of auto insurance is to protect individuals financially in case of accidents or damages involving their vehicles. It provides coverage for medical expenses, property damage, and legal liabilities. While this protection is vital for all drivers, it becomes even more critical for homeless individuals who may lack other safety nets.

Without auto insurance, a single accident could lead to devastating financial consequences, potentially exacerbating an already precarious situation. The costs associated with repairs, medical bills, and legal fees can quickly spiral out of control, pushing individuals further into hardship.

Furthermore, driving without insurance is illegal in most states and carries severe penalties, including fines, license suspension, and even jail time. This adds another layer of complexity for homeless individuals who may already be struggling to meet their basic needs.

Challenges of Obtaining Coverage

Securing auto insurance for homeless individuals presents several unique challenges compared to those with traditional housing situations.

One primary obstacle is the requirement for a fixed address, which many insurers use for verification purposes. Traditional auto insurance companies often rely on mailing addresses for policy documents and communication, making it difficult for homeless individuals to meet these requirements.

Another challenge stems from the perception of increased risk associated with homelessness. Insurers may view individuals experiencing homelessness as having a higher likelihood of accidents or claims due to factors such as unstable living situations and potential financial constraints. This can lead to higher premiums or even outright rejection of applications.

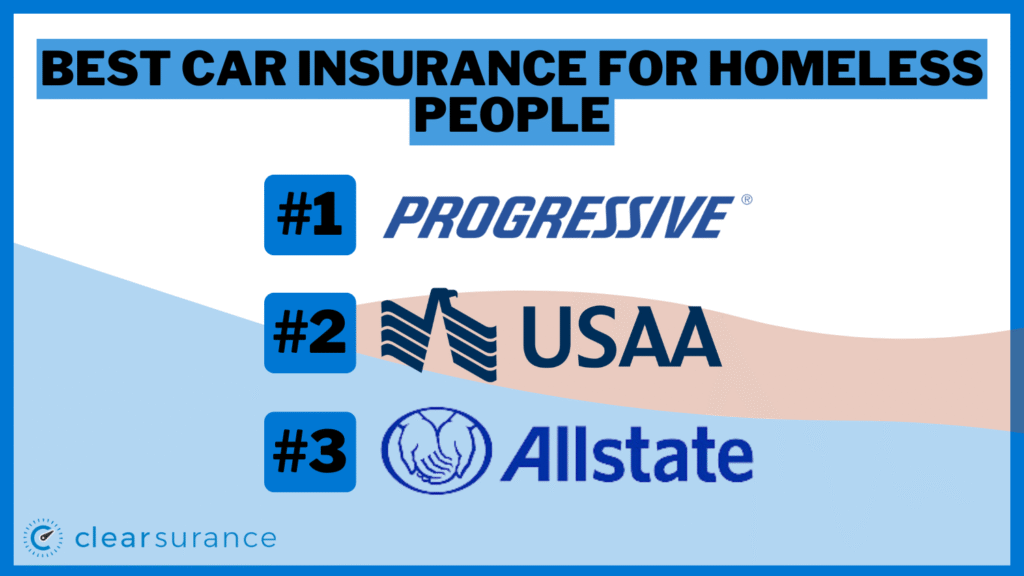

Specialized Insurance Providers

Fortunately, there are specialized insurance providers who recognize the unique needs of homeless individuals and offer tailored coverage options. These companies often have more flexible requirements regarding address verification and are committed to providing affordable insurance solutions for those facing housing insecurity.

When searching for specialized providers, consider contacting local non-profit organizations or social service agencies that may have partnerships with insurers catering to this demographic. Online research can also lead you to companies specializing in serving individuals experiencing homelessness.

Temporary Address Solutions

While securing a permanent address might not be immediately feasible, there are temporary address solutions that can help overcome the hurdle of traditional insurer requirements.

One option is to utilize a trusted friend or family member’s address for insurance purposes. Ensure they are willing to provide this information and understand the implications. Another possibility is to contact local shelters or transitional housing programs, as some may offer temporary addresses for official correspondence, including insurance documents.

Importance of Auto Insurance

Regardless of one’s housing situation, auto insurance remains a crucial safety net for all drivers. It provides financial protection in case of accidents, protects against legal liabilities, and ensures compliance with state laws.

For homeless individuals, the importance of auto insurance is amplified due to their potential vulnerability to financial hardship. Without coverage, a single accident could have devastating consequences, pushing them further into instability.

Conclusion

Securing auto insurance for homeless individuals presents unique challenges, but it’s not an insurmountable task. By exploring specialized insurance providers, utilizing temporary address solutions, and understanding the critical importance of coverage, homeless individuals can navigate this complex process and gain access to essential financial protection on the road. Remember, even in challenging circumstances, prioritizing safety and legal compliance is paramount.