Finding a new apartment can be an exciting but often stressful process. One of the most common hurdles renters face is providing sufficient proof of income to landlords. Landlords need to ensure you have the financial stability to comfortably afford rent payments. A key part of this process involves submitting pay stubs, which serve as tangible evidence of your current earnings.

This article will delve into the specifics of how many pay stubs landlords typically require for rental applications. We’ll explore the standard timeframe, factors influencing the number of pay stubs requested, and alternative proof of income options available to renters. By understanding these requirements, you can confidently navigate the application process and increase your chances of securing your dream apartment.

Pay Stubs for Rental Applications

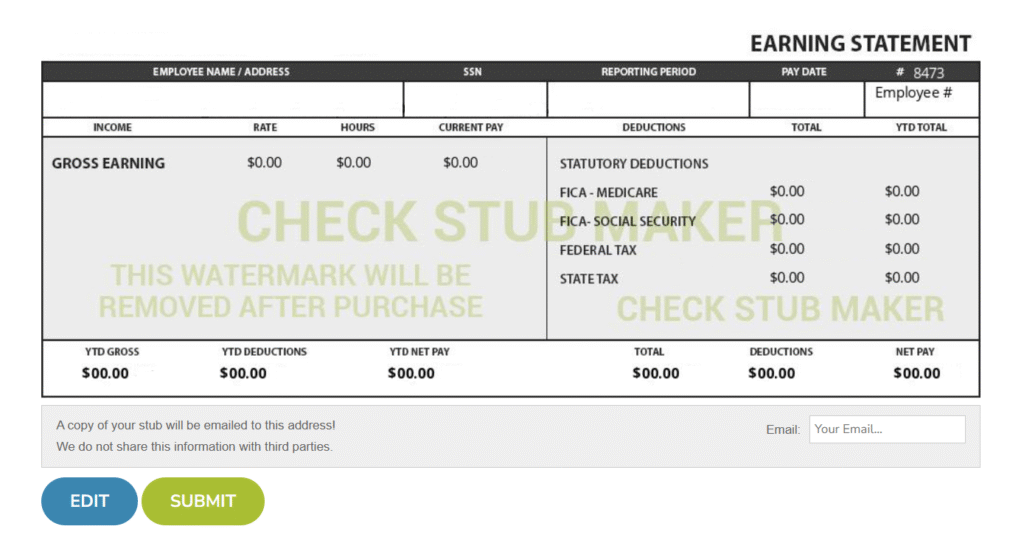

Pay stubs are essential documents that landlords use to verify your income and assess your ability to meet monthly rent obligations. They provide a detailed breakdown of your earnings, deductions, and net pay over a specific period. Landlords often request recent pay stubs as part of the rental application process to ensure you have a consistent and reliable source of income.

Submitting pay stubs demonstrates financial responsibility and transparency to potential landlords. It allows them to gauge your affordability and reduce the risk of late or missed rent payments. Pay stubs are typically required alongside other documents like credit reports, references, and employment verification letters.

Remember, providing accurate and up-to-date pay stubs is crucial for a successful rental application. Any discrepancies or inconsistencies can raise red flags for landlords and potentially hinder your chances of securing the apartment.

How Many Months of Pay Stubs?

The standard requirement for how many months of pay stubs do you need for an apartment typically falls between two to three months. Landlords often prefer recent pay stubs that reflect your current income situation.

However, specific requirements can vary depending on factors such as:

- Landlord’s preference: Some landlords may request a longer or shorter timeframe based on their individual policies and risk tolerance.

- Rental market conditions: In competitive rental markets, landlords might require more extensive documentation to thoroughly evaluate applicants.

- Applicant’s financial history: If an applicant has a limited credit history or inconsistent employment, landlords may request additional pay stubs for verification purposes.

Always clarify the specific requirements with the landlord or property manager to ensure you submit the appropriate documentation.

Landlord Income Verification

Landlords have a vested interest in verifying your income to protect their investment and minimize financial risks. They rely on how many pay stubs do i need for an apartment as primary evidence of your ability to meet rent obligations consistently.

Beyond pay stubs, landlords may also consider:

- Bank statements: Recent bank statements can provide a broader picture of your financial activity and demonstrate consistent income deposits.

- Tax returns: Previous tax returns can offer further proof of income and stability over a longer period.

- Employment verification letters: These letters confirm your current employment status, salary, and tenure with the company.

Landlords may request a combination of these documents to conduct a comprehensive income verification process.

Proof of Income Alternatives

While pay stubs are commonly required, there are alternative proof of income options available for renters who may not have traditional employment:

- Self-employment documentation: If you’re self-employed, provide tax returns, profit and loss statements, or invoices to demonstrate your income.

- Retirement income: Submit pension statements, Social Security benefit letters, or annuity contracts as proof of regular income.

- Government assistance: Provide documentation from government agencies such as SNAP benefits or unemployment compensation.

Communicate openly with the landlord about your unique financial situation and provide any relevant documentation to support your application.

Conclusion

Understanding the requirements for how many pay stubs do apartments need is crucial for a successful rental application process. Landlords typically require two to three months of recent pay stubs to verify your income and assess your affordability.

Remember to clarify specific requirements with the landlord, provide accurate documentation, and explore alternative proof of income options if applicable. By being prepared and transparent, you can increase your chances of securing your desired apartment and embarking on a smooth rental experience.