Managing your finances effectively often hinges on having a clear understanding of your income and expenses. Direct deposit, a convenient way to receive your paycheck electronically, can be further optimized by choosing a flat amount for direct deposit. This means receiving a fixed sum each pay period, regardless of the number of hours worked or your actual earnings.

This article will delve into the concept of flat direct deposit, exploring its benefits, how to set it up, and why it might be a superior choice compared to percentage-based deposits. We’ll also discuss how this method can significantly simplify your budgeting process and enhance financial predictability.

What is Flat Direct Deposit?

Flat direct deposit involves receiving a predetermined, fixed amount of money into your bank account with each paycheck. This sum remains constant regardless of the number of hours you work or any fluctuations in your earnings during that pay period. For example, if you choose to receive $1,500 via flat direct deposit every two weeks, that amount will be deposited consistently, even if you worked fewer hours one week due to a holiday or personal leave.

This differs from percentage-based direct deposit, where the amount deposited is calculated as a percentage of your total earnings for that pay period. Percentage-based deposits can lead to unpredictable income streams, making budgeting more challenging.

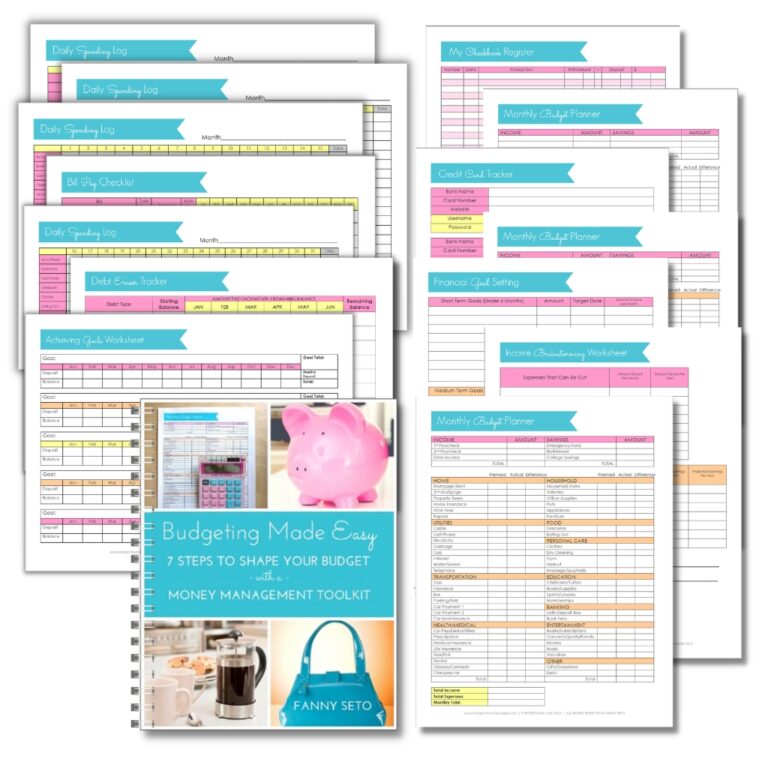

Benefits of Flat Direct Deposit for Budgeting

One of the most significant advantages of flat direct deposit is its ability to streamline your budgeting process. With a consistent and predictable income flow, you can easily allocate funds for various expenses, such as rent, utilities, groceries, and entertainment.

Enhanced Financial Predictability

Knowing exactly how much money will be deposited into your account each pay period allows you to create a realistic budget and track your spending more effectively. This predictability reduces financial stress and empowers you to make informed decisions about your finances.

Simplified Expense Tracking

A flat amount for direct deposit makes it easier to categorize and track your expenses. Since your income is consistent, you can allocate specific amounts to different expense categories each month, ensuring that you stay within your budget limits.

How to Set Up Flat Direct Deposit

Setting up flat direct deposit is a straightforward process that typically involves providing your employer with your bank account information and specifying the desired flat amount for direct deposit.

- Gather Your Information: You’ll need your bank account number, routing number, and the desired flat amount for direct deposit.

- Contact Your Employer: Inform your Human Resources department or payroll administrator that you wish to set up flat direct deposit. They will provide you with the necessary forms or instructions.

- Complete the Forms: Fill out the required forms accurately and completely, ensuring that all information is correct.

- Submit Your Forms: Submit the completed forms to your employer according to their specified procedures.

Advantages Over Percentage-Based Deposits

While percentage-based direct deposit may seem appealing due to its potential for higher earnings in some cases, it often leads to unpredictable income streams and budgeting challenges. Flat direct deposit, on the other hand, offers several advantages:

Predictability and Control

With a flat amount for direct deposit, you have complete control over your income flow. This predictability allows you to plan your expenses effectively and avoid financial surprises.

Reduced Stress and Anxiety

The uncertainty associated with percentage-based deposits can contribute to financial stress and anxiety. Flat direct deposit eliminates this uncertainty, providing peace of mind and a sense of stability.

Conclusion

Choosing flat direct deposit offers numerous benefits for individuals seeking to simplify their budgeting process and enhance financial predictability. By receiving a consistent and predetermined amount each pay period, you can effectively allocate funds, track expenses, and make informed financial decisions. If you’re looking for a reliable and straightforward way to manage your finances, consider switching to flat direct deposit today.