Getting stuck on the side of the road is never fun, and when you need a tow truck, it can feel like a stressful situation. One of the first things that might cross your mind is “who pays for this?” Understanding who’s responsible for towing costs and how to cover them can make a big difference in managing this unexpected expense. This article will break down the basics of tow truck costs, insurance coverage, and payment options to help you navigate this situation with confidence.

This article will explore the typical costs associated with towing services, delve into who is usually responsible for paying these fees, examine whether your insurance policy might cover towing expenses, and discuss various payment methods available to you when calling a tow truck.

Tow Truck Costs

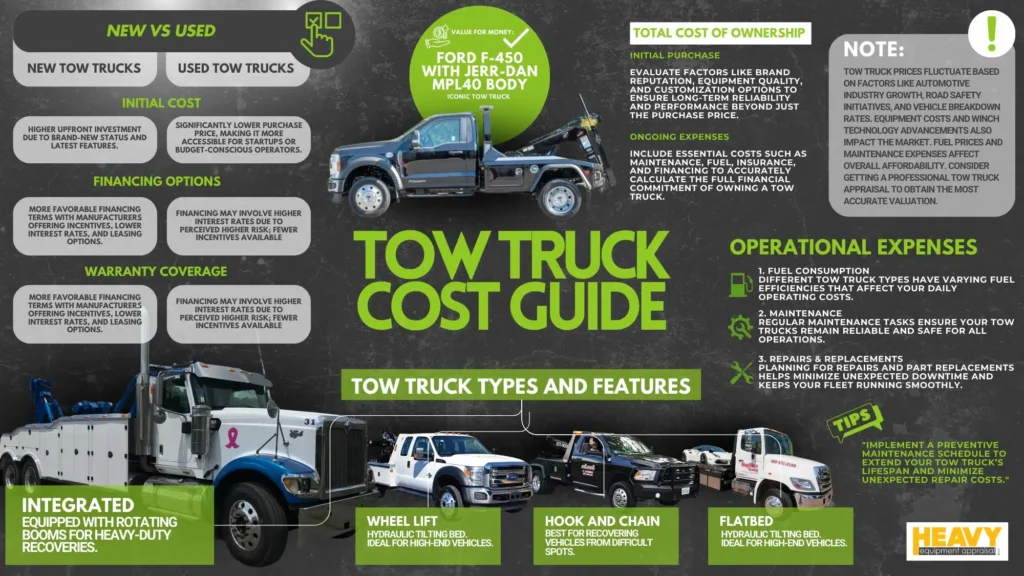

Tow truck prices can vary significantly depending on several factors. Location plays a major role, with urban areas generally charging more than rural regions. The distance the vehicle needs to be towed also influences the cost, as longer distances require more time and fuel. The type of vehicle being towed matters too; larger or heavier vehicles often incur higher towing fees.

Additional factors that can affect tow truck costs include:

- Time of day: Towing services may charge a premium for after-hours or emergency calls.

- Day of the week: Weekend or holiday towing might come with additional surcharges.

- Type of service: A basic tow is typically less expensive than specialized services like winching or flatbed towing.

It’s always best to inquire about pricing upfront before authorizing a tow truck driver to avoid any surprises.

Who Pays for Towing?

Generally, the person whose vehicle requires towing is responsible for covering the associated costs. This means if your car breaks down and needs to be towed to a repair shop, you’ll likely be the one footing the bill.

There are some exceptions to this rule:

- Accidents: If your vehicle is involved in an accident that isn’t your fault, the at-fault driver’s insurance may cover towing expenses.

- Roadside Assistance: If you have a roadside assistance plan through your car manufacturer or a third-party provider, they might cover towing costs as part of their service benefits.

It’s important to clarify who is responsible for payment before calling a tow truck to avoid any misunderstandings or disputes later on.

Insurance Coverage for Towing

While some insurance policies include towing coverage as a standard benefit, others may offer it as an optional add-on. If you have comprehensive or collision coverage, there’s a chance your policy might cover towing expenses in certain situations, such as:

- Breakdown: Your insurance might cover towing if your vehicle breaks down due to mechanical failure.

- Accident: If your car is involved in an accident, your insurance may pay for towing to a repair shop or your home.

It’s crucial to review your insurance policy documents carefully to determine what towing coverage you have and any limitations that apply. Contacting your insurance company directly can also provide clarity on your specific coverage.

Paying for a Tow Truck

When it comes time to pay for a tow truck, you typically have several options:

- Cash: Many tow truck drivers accept cash payments, which is often the most straightforward method.

- Credit Card: Most reputable towing companies accept major credit cards for payment.

- Check: Some tow truck operators may accept checks, but it’s best to confirm this beforehand.

If you’re unsure about how to pay or have questions about billing, don’t hesitate to ask the tow truck driver for clarification.

Conclusion

Understanding who pays for towing and how to cover these expenses can make a stressful situation more manageable. While the person whose vehicle requires towing is typically responsible for the costs, insurance coverage and roadside assistance plans might offer some financial relief. By reviewing your policy documents, exploring payment options, and communicating clearly with tow truck operators, you can navigate this unexpected expense with greater confidence.