The world of accounting can seem like a labyrinth of complex terms and codes. One such term that might leave you scratching your head is “c/h accounting credit adjustment.” This seemingly cryptic phrase actually refers to a common financial transaction with significant implications for businesses. In this article, we’ll delve into the meaning of “c/h accounting credit adjustment,” decipher the often-confusing codes associated with it (like “FDES NNf”), and explore its Spanish translation (“que significa en español”). By understanding these concepts, you can gain valuable insights into your company’s financial health.

This article will break down the definition of a c/h accounting credit adjustment, explain the meaning behind the codes “FDES NNf,” provide the Spanish translation for “que significa en español,” and highlight the importance of comprehending these codes for accurate financial reporting and analysis.

C/H Accounting Credit Adjustment Definition

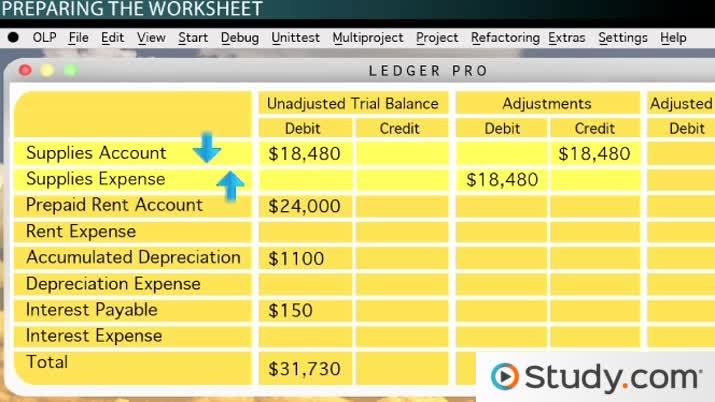

A c/h accounting credit adjustment is a financial transaction where a credit entry is made to reduce an existing debit balance in a company’s accounts. Essentially, it involves offsetting a previous debit with a corresponding credit, ultimately resulting in a net change to the account balance.

These adjustments are often necessary to correct errors, account for unforeseen circumstances, or reflect changes in financial information. For example, if a company mistakenly overcharged a customer, they would issue a credit adjustment to refund the excess amount. Similarly, if a supplier returns goods to a company, a credit adjustment would be recorded to reduce the company’s accounts payable balance.

Credit adjustments are crucial for maintaining accurate financial records and ensuring that all transactions are properly reflected in a company’s books. They play a vital role in the overall accounting process, contributing to the reliability and integrity of financial statements.

FDES NNf Codes Explained

Within the realm of accounting, specific codes are often used to categorize and identify different types of transactions. In this context, “FDES NNf” likely represents internal codes or abbreviations employed by a particular company or accounting system.

Without access to the specific company’s documentation or accounting software, it is impossible to definitively decipher the meaning of these codes. However, we can speculate that “FDES” might stand for “Financial Data Entry System,” while “NNf” could represent a specific category or type of credit adjustment within that system.

It’s important to note that these are just educated guesses, and the true meaning of these codes would require further investigation into the company’s internal accounting practices.

Spanish Meaning (Que Significa en Español)

The phrase “que significa en español” translates directly to “what does it mean in Spanish?” In this context, it refers to the translation of the term “c/h accounting credit adjustment” and the codes “FDES NNf.”

While a direct translation might not always capture the nuances of an accounting term, we can attempt to provide a general understanding:

- C/H Accounting Credit Adjustment: Ajuste de crédito contable C/H

- FDES NNf: Códigos FDES NNf (This would likely be explained within the company’s internal documentation)

Remember that specific terminology and translations may vary depending on the industry, region, or company.

Importance of Understanding Codes

Comprehending accounting codes and their meanings is crucial for several reasons:

- Accurate Financial Reporting: Codes ensure consistency and accuracy in financial records, enabling businesses to generate reliable financial statements.

- Effective Analysis: Understanding codes allows accountants and analysts to interpret financial data more effectively, identifying trends and patterns that might otherwise go unnoticed.

- Improved Communication: Codes provide a common language for communication between different departments within a company, facilitating smoother collaboration and decision-making.

By investing time in understanding accounting codes, businesses can enhance their financial management practices and gain valuable insights into their operations.

Conclusion

Navigating the world of accounting can be challenging, but understanding key terms like “c/h accounting credit adjustment” and associated codes is essential for accurate financial reporting and analysis. While specific code meanings may vary depending on the company or system, grasping the fundamental concepts behind these terms empowers businesses to make informed decisions and maintain sound financial practices.