In today’s fast-paced business environment, accuracy is paramount. Mistakes can have costly consequences, impacting everything from financial reports to customer satisfaction. To minimize the risk of errors and ensure reliable data, businesses often employ a rigorous verification process known as “cross check and all call.” This involves meticulously double-checking information against multiple sources and contacting all relevant parties to confirm its validity.

This article delves into the meaning of “cross check and all call,” exploring its components, significance, and wide-ranging applications across various industries. We’ll examine the definition of cross checking, the process involved in an all call, and the crucial role accuracy plays in business success. Furthermore, we’ll highlight the benefits of implementing this verification method and showcase its diverse applications in different sectors.

Cross Check Definition

“Cross check” refers to the practice of verifying information by comparing it against multiple sources. This involves consulting various documents, databases, records, or even individuals who possess relevant knowledge. The goal is to ensure consistency and identify any discrepancies that might indicate errors or inconsistencies.

For example, when processing a financial transaction, a cross check might involve comparing the invoice amount with the purchase order, bank statement, and supplier confirmation. This multi-source verification helps prevent fraudulent activities, data entry mistakes, and inaccurate financial reporting.

Techniques for Effective Cross Checking

Several techniques can enhance the effectiveness of cross checking:

- Triangulation: Comparing information from three or more independent sources to increase confidence in its accuracy.

- Data Validation Rules: Implementing predefined rules within systems to automatically flag inconsistencies or potential errors during data entry.

- Regular Audits: Conducting periodic reviews of records and processes to identify recurring issues and improve accuracy over time.

All Call Process

An “all call” involves contacting all relevant parties involved in a particular process or transaction to gather information, confirm details, and ensure everyone is on the same page. This comprehensive communication strategy helps prevent misunderstandings, resolve conflicts, and maintain transparency throughout the process.

The specific steps involved in an all call may vary depending on the context. However, common practices include:

- Creating a Contact List: Identifying all individuals or departments that need to be contacted for the specific purpose.

- Developing a Communication Plan: Outlining the message, format (email, phone call, meeting), and desired outcome for each communication.

- Conducting Follow-Up: Ensuring timely responses and addressing any outstanding questions or concerns raised during the all call process.

Benefits of an All Call Process

An effective all call process offers several benefits:

- Enhanced Collaboration: Fosters open communication and encourages active participation from all stakeholders.

- Improved Decision-Making: Provides a comprehensive understanding of different perspectives and potential challenges, leading to more informed decisions.

- Reduced Risk of Errors: By verifying information with multiple sources and parties, the likelihood of mistakes is significantly reduced.

Importance of Accuracy in Business

Accuracy plays a crucial role in every aspect of business operations. Inaccurate data can lead to flawed decision-making, financial losses, damaged reputation, and even legal repercussions.

Consider these examples:

- Financial Reporting: Inaccurate financial statements can mislead investors, creditors, and regulators, potentially resulting in severe penalties or lawsuits.

- Customer Service: Providing incorrect information to customers can erode trust, lead to dissatisfaction, and ultimately result in lost business.

- Operations Management: Inaccurate inventory data can disrupt production schedules, lead to stockouts, and increase costs.

Benefits of Cross Checking and All Calling

Implementing a robust cross check and all call process offers numerous benefits for businesses:

- Reduced Errors: By verifying information from multiple sources and contacting relevant parties, the risk of human error is significantly minimized.

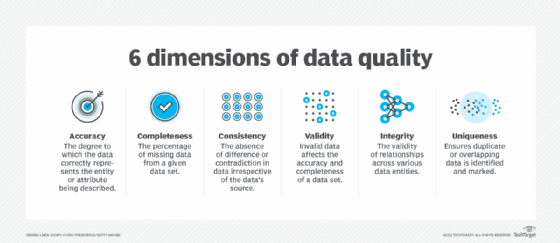

- Improved Data Quality: Ensures that data used for decision-making is reliable, consistent, and accurate.

- Enhanced Transparency: Promotes open communication and collaboration among stakeholders, fostering trust and accountability.

- Increased Efficiency: By identifying and resolving issues early on, cross checking and all calling can prevent costly delays and rework.

Applications Across Industries

The principles of cross check and all call are applicable across a wide range of industries:

- Finance: Verifying financial transactions, conducting due diligence, and ensuring accurate reporting.

- Healthcare: Confirming patient information, verifying medical records, and preventing medication errors.

- Legal: Cross-referencing legal documents, conducting background checks, and ensuring compliance with regulations.

- Manufacturing: Tracking inventory levels, verifying production data, and maintaining quality control.

Conclusion

In today’s competitive business landscape, accuracy is non-negotiable. Implementing a comprehensive cross check and all call process is essential for mitigating errors, ensuring data integrity, and fostering trust among stakeholders. By embracing this rigorous verification method, businesses can enhance their decision-making processes, improve operational efficiency, and ultimately achieve greater success.