The question of whether do homeless people have to pay taxes is a complex one that often arises due to misconceptions surrounding homelessness and tax obligations. While it’s true that everyone has a responsibility to comply with tax laws, the reality for individuals experiencing homelessness is significantly different from those with stable housing. This article aims to shed light on the specific tax requirements applicable to homeless individuals, clarifying their responsibilities and potential exemptions.

This article will delve into the intricacies of do homeless people have to pay taxes, exploring the filing thresholds, federal income tax obligations, and local tax considerations relevant to this population. By understanding these nuances, we can foster a more informed and compassionate approach to addressing the financial realities faced by individuals experiencing homelessness.

Homeless Tax Filing Requirements

Homeless individuals are generally not required to file income tax returns if their earnings fall below the established filing threshold set by the Internal Revenue Service (IRS). This means that if an individual’s total income for the year is less than the minimum threshold, they are not legally obligated to submit a federal income tax return. However, it’s important to note that this exemption applies solely to federal income taxes and may not encompass other types of taxes levied at the local or state level.

Despite the potential exemption from federal filing requirements, homeless individuals should still maintain accurate records of their income and expenses throughout the year. This documentation can be crucial for accessing various social services, applying for housing assistance, or navigating other financial aid programs. Moreover, keeping track of income and expenditures can help individuals better understand their financial situation and make informed decisions about managing their resources.

Filing Threshold for Homeless Individuals

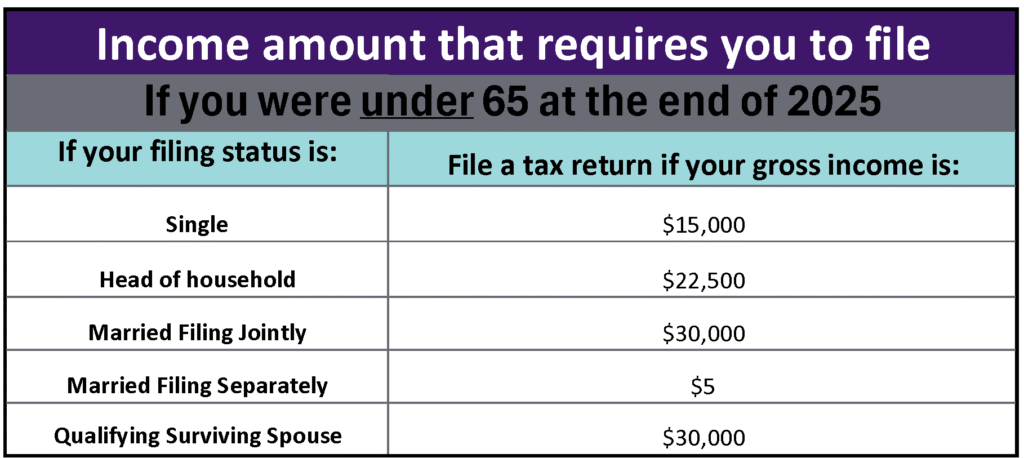

The filing threshold for federal income tax purposes is determined annually by the IRS and varies based on factors such as filing status (single, married, etc.) and age. For example, in 2023, the standard deduction for single filers is $13,850. This means that if a homeless individual’s total income for the year is less than $13,850, they are generally not required to file a federal income tax return.

It’s crucial to remember that this threshold only applies to federal income taxes and does not necessarily reflect local or state tax requirements. Some jurisdictions may have their own filing thresholds or exemptions specific to homeless individuals. Therefore, it is always advisable for homeless individuals to consult with a qualified tax professional or seek guidance from relevant social service organizations to determine their specific tax obligations.

Federal Income Tax Obligations

While the filing threshold exemption applies to many homeless individuals, those whose income exceeds the established limit are still subject to federal income tax obligations. This means that they must file an annual tax return and pay any applicable taxes owed based on their earnings. However, there are several provisions within the federal tax code designed to provide relief and support for low-income taxpayers, including those experiencing homelessness.

For instance, the Earned Income Tax Credit (EITC) is a refundable tax credit available to working individuals and families with low to moderate incomes. This credit can significantly reduce an individual’s tax liability or even result in a refund, providing valuable financial assistance. Additionally, various deductions and exemptions are available to taxpayers facing financial hardship, which may help alleviate the burden of federal income taxes.

Local Taxes and Homelessness

In addition to federal income taxes, homeless individuals may also be subject to local taxes depending on their location. These taxes can include property taxes (if they temporarily occupy a space), sales taxes, or even local income taxes. The specific tax requirements vary widely across jurisdictions, so it is essential for homeless individuals to research the local tax laws in their area.

Some cities and counties offer programs or exemptions specifically designed to assist homeless individuals with navigating local tax obligations. These programs may provide free tax preparation services, guidance on filing requirements, or even assistance with paying outstanding taxes. Homeless individuals should reach out to local social service agencies or community organizations to inquire about available resources and support in their area.

Conclusion

The question of do homeless people have to pay taxes is multifaceted and requires a nuanced understanding of federal, state, and local tax laws. While the filing threshold exemption generally applies to those with low incomes, it’s crucial for homeless individuals to maintain accurate financial records and seek guidance from qualified professionals or social service organizations to ensure compliance with their specific tax obligations.