Navigating the world of insurance reimbursement can feel overwhelming. Between gathering documentation, understanding policy specifics, and crafting a compelling claim, it’s easy to get lost in the process. A well-written statement for insurance reimbursement is crucial for ensuring your claim is processed efficiently and accurately. This article will guide you through the essentials of creating a strong reimbursement statement, offering free templates and valuable tips to maximize your chances of receiving prompt payment.

This comprehensive guide will explore the key elements of an effective statement for insurance reimbursement, provide access to free downloadable templates, and offer practical advice on maximizing claim accuracy and streamlining the reimbursement process. By following these steps, you can confidently submit your claims and increase your likelihood of a successful outcome.

Insurance Reimbursement Statements

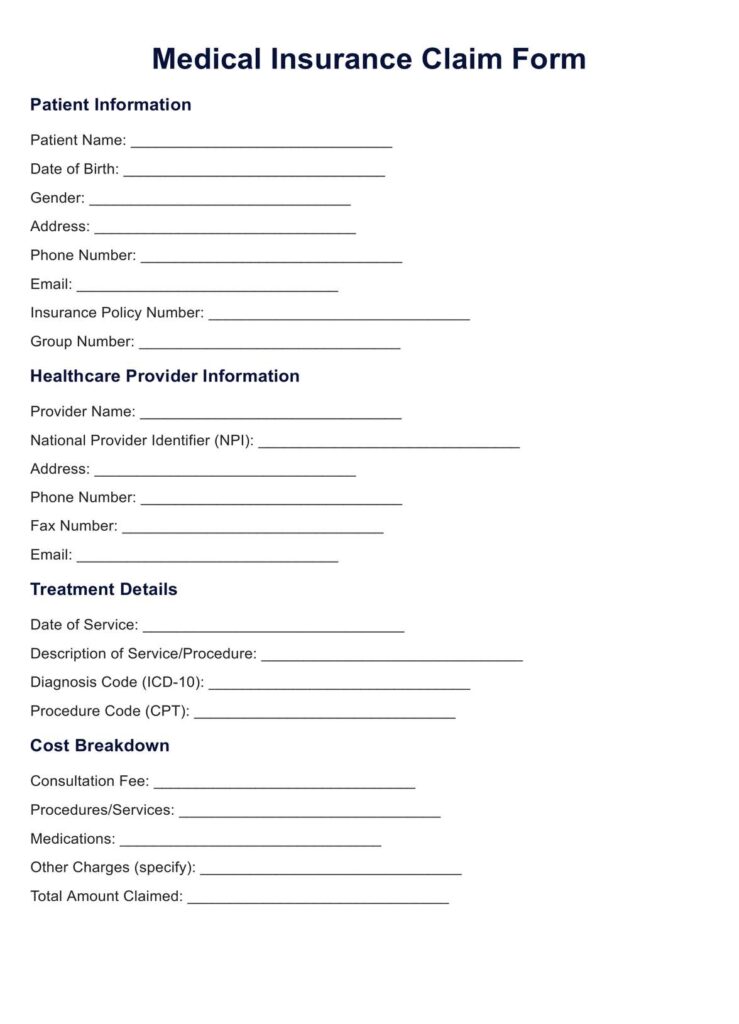

A statement for insurance reimbursement is a formal document that outlines the details of your medical expenses or other covered services and requests payment from your insurance provider. It serves as the primary communication tool between you and your insurer, detailing the nature of your claim and supporting documentation. A clear and concise statement significantly increases the chances of prompt processing and approval.

When crafting your statement for insurance reimbursement, accuracy is paramount. Ensure all information aligns with your policy documents and medical records. Include specific details such as dates of service, diagnoses, treatment codes, and the total amount billed by healthcare providers. Providing comprehensive and accurate information minimizes the risk of delays or denials due to missing or incorrect data.

Remember, your statement for insurance reimbursement should be professional and well-organized. Use a clear and legible font, maintain consistent formatting throughout, and proofread carefully before submission. A polished and error-free document reflects attention to detail and enhances your credibility with the insurance provider.

Free Templates

To simplify the process of creating a statement for insurance reimbursement, we offer free downloadable templates tailored to various situations. These templates provide a structured framework, ensuring you include all essential information and adhere to industry standards.

Simply download the template that best suits your needs, fill in the required details, and submit it to your insurance provider. Our templates are designed to be user-friendly and adaptable, allowing you to customize them further if necessary.

Claim Accuracy Tips

Ensuring accuracy is crucial for a successful statement for insurance reimbursement. Here are some tips to minimize errors and maximize your chances of approval:

Verify Your Policy Coverage

Before submitting your claim, carefully review your policy documents to understand your coverage limits, deductibles, and co-pays. This ensures you submit eligible expenses and avoid unnecessary delays.

Double-Check Medical Records

Carefully review your medical records for accuracy and completeness. Ensure all diagnoses, procedures, and dates of service are correctly documented. Discrepancies can lead to claim denials, so meticulous attention to detail is essential.

Utilize Supporting Documentation

Attach relevant supporting documentation to your statement for insurance reimbursement, such as receipts, invoices, prescriptions, and medical reports. This provides concrete evidence to support your claim and strengthens your case.

Streamline Reimbursement Process

Several strategies can help streamline the reimbursement process and expedite payment:

Submit Claims Electronically

Many insurance providers offer online portals for submitting claims electronically. This method is often faster and more efficient than traditional paper submissions.

Follow Up Promptly

After submitting your claim, follow up with your insurance provider to confirm receipt and inquire about the processing timeline. Proactive communication demonstrates your commitment to resolving the matter efficiently.

Maintain Organized Records

Keep meticulous records of all correspondence, receipts, and documentation related to your claim. This organized approach simplifies tracking and facilitates communication with your insurer.

Maximize Payment Chances

To maximize your chances of receiving full payment for your statement for insurance reimbursement, consider these strategies:

Appeal Denied Claims

If your claim is denied, don’t hesitate to appeal the decision. Thoroughly review the denial letter, gather supporting documentation, and present a compelling case for reconsideration.

Negotiate Payment Plans

In cases of large medical bills, explore the possibility of negotiating a payment plan with your healthcare provider or insurance company. This can alleviate financial strain and ensure timely resolution.

Seek Professional Assistance

If you encounter persistent difficulties navigating the reimbursement process, consider seeking assistance from a healthcare advocate or legal professional. They can provide expert guidance and support in resolving complex claims issues.

Conclusion

Crafting a clear and accurate statement for insurance reimbursement is essential for securing prompt and efficient payment for your medical expenses or covered services. By utilizing free templates, adhering to claim accuracy tips, streamlining the process, and maximizing payment chances, you can confidently navigate the complexities of insurance reimbursement and achieve a successful outcome. Remember, thorough preparation and proactive communication are key to ensuring a smooth and rewarding experience.