Navigating the world of insurance can be complex, especially when dealing with payouts for damages or losses. While receiving an insurance payout might seem like a solution to your problems, it’s crucial to understand that simply having the money isn’t enough. Failing to utilize these funds for necessary repairs can have serious consequences down the line. This article will delve into the potential pitfalls of delaying repairs after receiving an insurance payout, exploring the financial and legal ramifications you might face.

This comprehensive guide will cover the importance of timely repairs following an insured event, outlining the potential financial burdens and legal complications that arise from neglecting these obligations. We’ll also shed light on the specific policy terms and obligations you need to be aware of to ensure you’re fulfilling your end of the agreement with your insurance provider.

Insurance Payouts

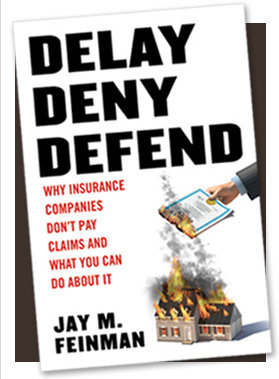

Insurance payouts are designed to help individuals and businesses recover financially after experiencing covered damages or losses. Whether it’s a fire, flood, theft, or accident, your insurance policy is intended to provide financial assistance for repairs or replacements. However, it’s important to remember that these payouts are not free money. They are meant to be used specifically for the purpose of restoring your property to its pre-loss condition.

When you receive an insurance payout, it signifies that your insurer acknowledges the damage and agrees to contribute financially towards its repair or replacement. This financial assistance is a crucial lifeline, allowing you to rebuild, recover, and get back on track after a difficult event. It’s essential to treat these funds with responsibility and utilize them for their intended purpose.

Necessary Repairs

Necessary repairs are those that are essential for restoring your property to a safe and functional state following a covered event. These repairs might include fixing structural damage, replacing damaged appliances or fixtures, repairing roofs or walls, or addressing any safety hazards created by the loss. Delaying these repairs can lead to further deterioration of your property, creating more extensive and costly problems down the line.

For example, if you have water damage in your home due to a burst pipe, it’s crucial to address the issue promptly. Ignoring the leak could lead to mold growth, structural damage, and even health hazards. Similarly, if your roof is damaged by a storm, delaying repairs could expose your home to further weather damage, leading to more extensive and expensive repairs in the future.

The Importance of Prompt Action

Timely action is crucial when it comes to necessary repairs after an insured event. The longer you wait, the greater the risk of further damage and escalating repair costs.

Prompt repairs not only protect your property’s value but also ensure the safety and well-being of yourself and your family.

Financial Burdens

Failing to utilize insurance payouts for necessary repairs can lead to significant financial burdens in the long run. As mentioned earlier, delaying repairs allows damage to worsen, resulting in more extensive and costly fixes down the line. This means you’ll likely end up spending more money out of pocket than if you had addressed the issue promptly after receiving your payout.

Furthermore, neglecting repairs can impact your property’s value. A home with visible damage or unresolved issues will be less appealing to potential buyers, leading to a lower selling price when you decide to sell. This financial loss can be substantial, especially if you were planning on using the sale proceeds for other significant expenses.

Legal Complications

While not always immediate, neglecting repairs after receiving an insurance payout can potentially lead to legal complications. Some insurance policies stipulate that repairs must be completed within a specific timeframe, and failure to comply could void coverage for future claims. This means you might find yourself financially responsible for any future damages or losses if you haven’t fulfilled your obligations outlined in the policy.

Additionally, if your property becomes unsafe due to neglected repairs, you could face legal action from individuals who are injured on your property. This could result in costly lawsuits and damage to your reputation.

Policy Terms and Obligations

Understanding your insurance policy terms and obligations is crucial for avoiding potential pitfalls. Carefully review your policy documents to determine the specific requirements regarding repairs after a covered event. Pay attention to any timeframes mentioned for completing repairs, as well as any stipulations about using the payout solely for its intended purpose.

Don’t hesitate to contact your insurance provider if you have any questions or need clarification on specific terms. They can provide guidance and ensure you’re fulfilling your obligations under the policy.

Conclusion

Utilizing insurance payouts for necessary repairs is not just a financial responsibility but also a legal obligation in many cases. Delaying these repairs can lead to significant financial burdens, potential legal complications, and further damage to your property. By understanding your policy terms, acting promptly after an insured event, and utilizing the payout for its intended purpose, you can protect yourself from future headaches and ensure a smooth recovery process. Remember, insurance is designed to be a safety net, but it’s up to you to utilize it responsibly and effectively.