Turning 18 is a monumental moment in your life. It marks the transition from adolescence to adulthood, bringing with it a newfound sense of freedom and independence. This milestone unlocks a world of possibilities, granting you legal rights and responsibilities that shape your future. Understanding these changes is crucial as you navigate this exciting new chapter.

This article will delve into the various aspects of turning 18, covering your newly acquired legal rights, civic duties, financial obligations, educational opportunities, and career prospects. By exploring these areas, you’ll gain valuable insights into how to make informed decisions and build a fulfilling life as an adult.

Legal Rights at 18

Turning 18 grants you numerous legal rights that were previously unavailable. These rights empower you to participate fully in society and make your own choices. Some of the most significant things you have to do when you turn 18 include:

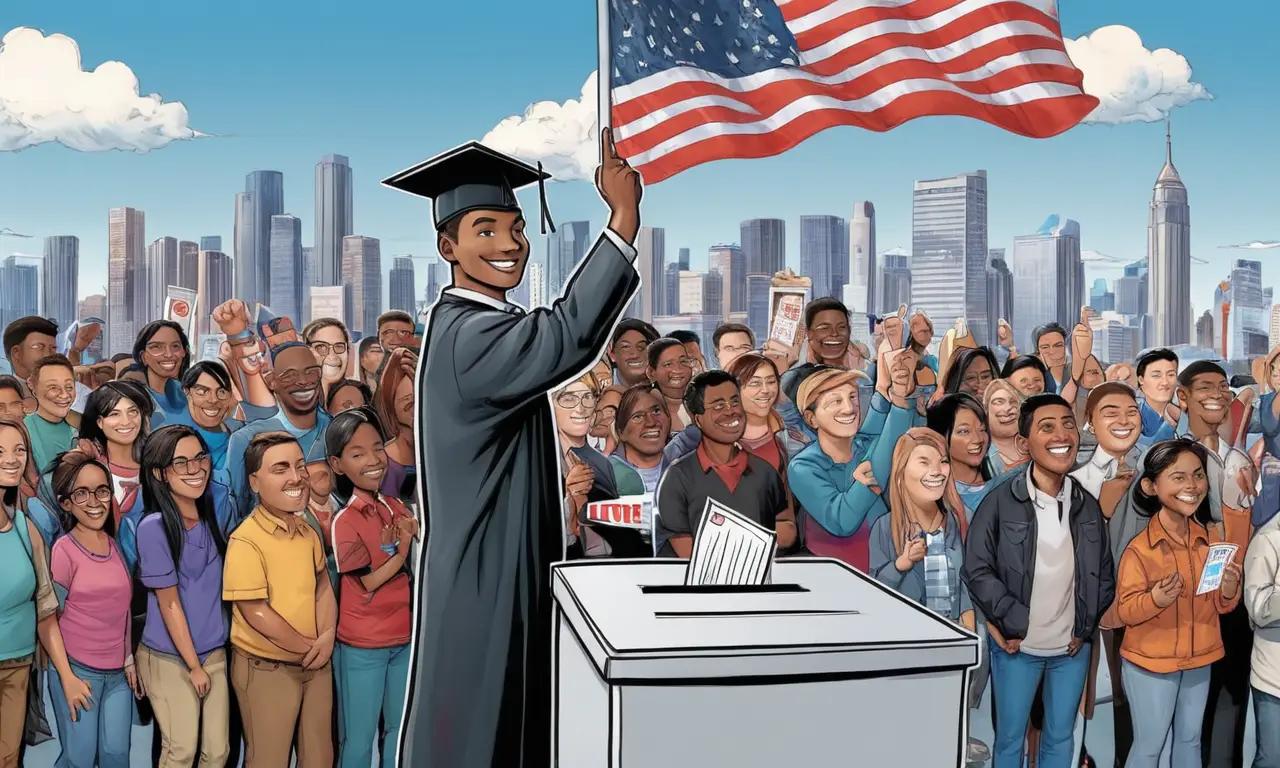

- Voting: You now have the right to vote in national, state, and local elections. Your voice matters, and exercising this right allows you to shape the policies that affect your community and country.

- Entering into Contracts: You are legally capable of entering into contracts, binding agreements with individuals or organizations. This includes leases for housing, employment agreements, and loan applications.

- Serving on a Jury: You may be called upon to serve on a jury in legal proceedings. This civic duty allows you to contribute to the justice system and ensure fair trials.

- Purchasing Firearms: In most jurisdictions, you can legally purchase firearms at age 18. However, it’s crucial to understand and comply with all applicable laws and regulations regarding firearm ownership and use.

Voting and Civic Engagement

Your right to vote is a cornerstone of democracy. It allows you to have a say in the decisions that shape your community and country. Beyond simply casting your ballot, active civic engagement involves:

- Staying Informed: Keep up-to-date on current events, political issues, and candidate platforms. Read news from diverse sources, attend town hall meetings, and engage in respectful discussions.

- Volunteering: Dedicate your time and skills to causes you believe in. Volunteering strengthens communities, addresses social issues, and fosters a sense of civic responsibility.

- Contacting Representatives: Reach out to your elected officials to express your views on legislation or policies that affect you. Your voice can make a difference in shaping government decisions.

Financial Responsibilities

Adulthood comes with financial responsibilities that require careful planning and management. Some key aspects include:

- Filing Taxes: You are now required to file federal income taxes annually, reporting your earnings and any applicable deductions or credits.

- Obtaining Insurance: Consider obtaining health insurance, renter’s or homeowner’s insurance, and auto insurance to protect yourself from financial risks.

- Managing a Budget: Create a budget that tracks your income and expenses. This will help you make informed spending decisions, save for future goals, and avoid debt.

Education and Career Options

Turning 18 opens doors to further education and career exploration. Consider these options:

- Higher Education: Explore colleges, universities, or vocational schools to pursue a degree or certification in your field of interest. Higher education can enhance your earning potential and career prospects.

- Part-Time Work: A part-time job can provide valuable work experience, income, and opportunities to develop new skills.

- Internships: Seek out internships in your desired industry to gain practical experience, build your network, and explore different career paths.

Building Credit History

Your credit history is a record of your financial responsibility. Start building a positive credit history by:

- Obtaining a Secured Credit Card: A secured credit card requires a security deposit that acts as your credit limit. This can be a good way to establish credit if you have limited or no prior credit history.

- Making Timely Payments: Always pay your bills on time, including rent, utilities, and any loans you may have. Late payments can negatively impact your credit score.

- Keeping Credit Utilization Low: Aim to use less than 30% of your available credit limit. High credit utilization can signal financial risk to lenders.

Conclusion

Turning 18 is a significant milestone that marks the beginning of your adult life. Embrace this new chapter with responsibility and enthusiasm. Exercise your legal rights, engage in civic activities, manage your finances wisely, explore educational and career opportunities, and build a strong credit history. Remember, adulthood offers countless possibilities for growth, learning, and making a positive impact on the world.