Navigating the world of taxes can be a daunting task, especially for young adults who are just starting out in their careers. Many students graduate high school without a fundamental understanding of basic tax principles, leaving them unprepared to file their own returns and potentially vulnerable to costly mistakes. This lack of financial literacy can have significant consequences, hindering their ability to manage their finances effectively and make informed decisions about their future.

This article delves into the reasons behind this concerning gap in tax education within our schools. We will explore the current state of financial literacy in classrooms, examine the impact of lacking tax knowledge on young adults, and argue for the importance of incorporating comprehensive tax curriculum into standard educational programs. Ultimately, we aim to shed light on the need to equip students with the essential skills they require to confidently navigate the complexities of taxes and become financially responsible citizens.

Tax Education Gap

The reality is that many schools simply do not prioritize tax education within their curriculums. While some institutions offer elective courses on personal finance, these are often optional and may not delve deeply into the intricacies of taxation. Consequently, a significant number of students graduate without acquiring a basic understanding of concepts such as income tax brackets, deductions, credits, filing deadlines, and different types of tax forms. This lack of foundational knowledge can create a significant obstacle when they enter the workforce and are required to file their own taxes for the first time.

Furthermore, the ever-evolving nature of tax laws adds another layer of complexity. Changes in legislation and regulations necessitate ongoing education and updates, making it crucial for individuals to possess a solid understanding of the fundamentals. Without proper instruction during their formative years, students may struggle to keep up with these changes and adapt to new requirements, potentially leading to errors or missed opportunities for tax savings.

Financial Literacy in Schools

Financial literacy is a vital life skill that equips individuals with the knowledge and tools to make informed decisions about their money. It encompasses a broad range of topics, including budgeting, saving, investing, borrowing, and understanding financial products and services. While personal finance education has gained increasing recognition in recent years, its implementation within schools remains inconsistent.

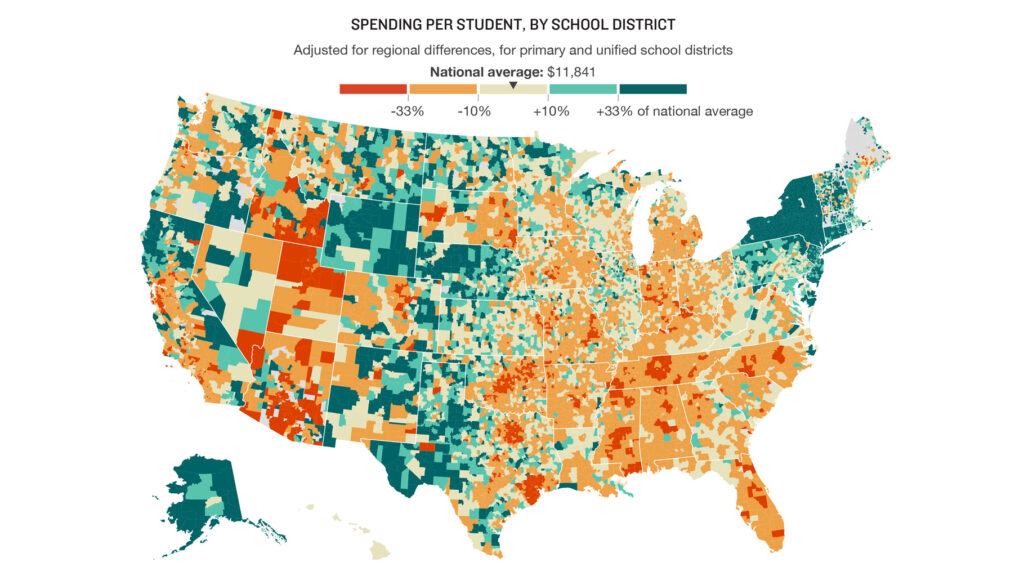

Some states have implemented mandatory personal finance courses as part of their graduation requirements, while others leave it to individual school districts to decide. This lack of uniformity creates disparities in the level of financial education students receive depending on their location. Moreover, even within schools that offer personal finance courses, the content and depth of instruction can vary widely.

Impact of Lack of Tax Knowledge

The consequences of lacking tax knowledge can be far-reaching and have a lasting impact on individuals’ financial well-being. One of the most common pitfalls is filing inaccurate tax returns, which can result in penalties, interest charges, and even legal action. Without a clear understanding of tax laws and regulations, students may inadvertently make mistakes that could cost them significant amounts of money.

Furthermore, failing to claim eligible deductions and credits can lead to missed opportunities for tax savings. These valuable benefits are designed to reduce an individual’s tax liability, but they often go unnoticed by those who lack the necessary knowledge to identify and utilize them effectively. As a result, individuals may end up paying more in taxes than they legally owe, hindering their ability to save or invest for their future.

Importance of Comprehensive Tax Curriculum

Incorporating a comprehensive tax curriculum into standard educational programs is essential for equipping students with the skills they need to navigate the complexities of taxation effectively. A well-designed curriculum should cover fundamental concepts such as income tax brackets, deductions, credits, filing deadlines, and different types of tax forms.

Moreover, it should emphasize practical applications by providing students with opportunities to work through real-life scenarios, such as calculating their own tax liability or preparing a sample tax return. By integrating interactive learning activities and simulations, educators can make the learning process more engaging and relevant to students’ lives.

Preparing Students for Adult Responsibilities

Tax knowledge is not merely an academic subject; it is a fundamental life skill that empowers individuals to take control of their financial future. When students graduate high school with a solid understanding of tax principles, they are better prepared to manage their finances responsibly, make informed decisions about their careers and investments, and contribute effectively to society.

By equipping them with the necessary tools and knowledge, we can help bridge the tax education gap and empower young adults to become financially literate citizens who are capable of navigating the complexities of the modern world.

Conclusion

The lack of comprehensive tax education in schools presents a significant challenge that requires immediate attention. By incorporating a robust tax curriculum into standard educational programs, we can equip students with the essential skills they need to manage their finances effectively and navigate the complexities of taxation throughout their lives. It is imperative that we prioritize financial literacy and empower young adults to become responsible stewards of their own economic well-being.