Navigating the world of health insurance can feel overwhelming, especially when faced with complex terminology and varying costs. One crucial concept to grasp is “cost per pay period health insurance,” which provides a clear picture of your monthly or bi-weekly contribution to your plan. Understanding this figure empowers you to effectively budget for healthcare expenses and make informed decisions about your coverage.

This article will delve into the intricacies of cost per pay period health insurance, breaking down its meaning, calculation methods, and implications for your financial planning. We’ll explore how to determine your cost per pay period and discuss various factors influencing premium costs. By the end, you’ll have a comprehensive understanding of this essential aspect of health insurance.

Health Insurance Costs

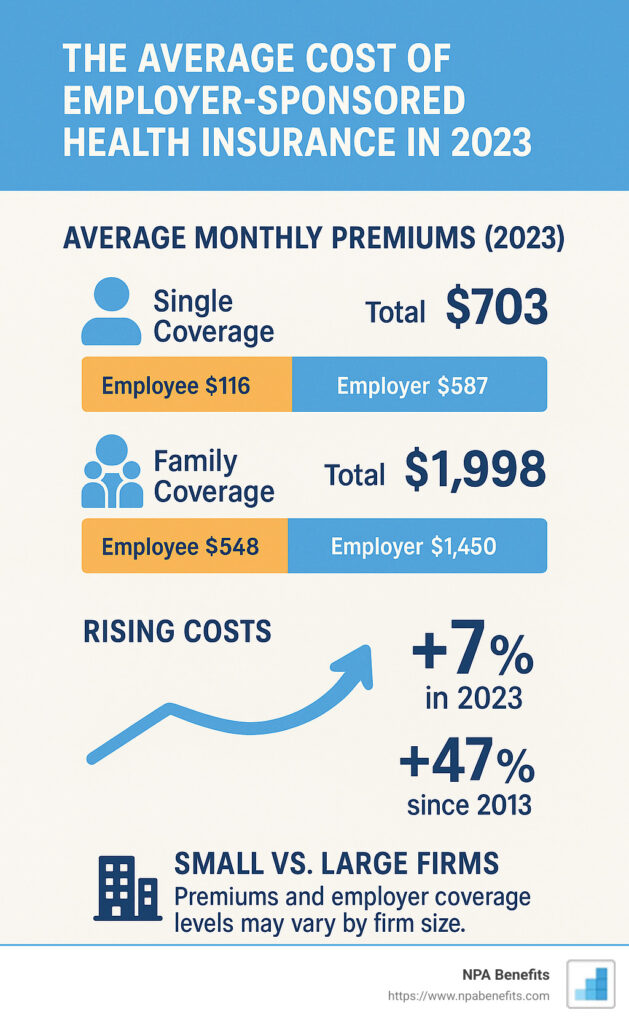

Health insurance premiums represent the recurring payments you make to maintain your coverage. These costs can vary significantly based on several factors, including:

- Plan Type: Different types of health insurance plans (HMO, PPO, EPO) offer varying levels of coverage and benefits, directly impacting premium prices.

- Coverage Level: The extent of coverage you choose, such as deductibles, co-pays, and out-of-pocket maximums, influences your premium costs. Higher coverage levels typically result in higher premiums.

- Location: Geographic location plays a role in healthcare costs, with premiums often higher in areas with higher medical expenses.

Understanding these factors is crucial for evaluating different health insurance options and selecting a plan that aligns with your needs and budget.

Per Pay Period Breakdown

The term “what does per pay period mean for insurance” refers to dividing the annual premium cost by the number of pay periods in a year. This calculation provides a more manageable figure, representing your monthly or bi-weekly contribution to your health insurance plan.

For example, if your annual premium is $6,000 and you are paid bi-weekly, your cost per pay period would be $230.77 ($6,000 / 26 pay periods). This breakdown allows for easier budgeting and tracking of healthcare expenses throughout the year.

Budgeting with Healthcare Expenses

Incorporating cost per pay period health insurance into your budget is essential for financial stability. By factoring in this recurring expense alongside other monthly obligations, you can create a realistic budget that accommodates your healthcare needs.

Consider using budgeting tools or apps to track your income and expenses, including your cost per pay period. Regularly reviewing your budget allows you to identify areas where adjustments can be made to ensure you are meeting your financial goals while maintaining adequate health insurance coverage.

Premium Calculation

Several factors influence the calculation of your health insurance premium:

- Age: Premiums generally increase with age due to higher healthcare utilization rates among older individuals.

- Tobacco Use: Smokers typically face higher premiums due to increased healthcare risks associated with smoking.

- Family Size: Larger families often require more comprehensive coverage, leading to higher premiums.

- Health Status: Pre-existing conditions may result in higher premiums based on the potential for increased medical expenses.

Understanding these factors can help you anticipate your premium costs and make informed decisions about your health insurance plan.

Coverage Options

When evaluating health insurance plans, consider various coverage options:

- Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums but require greater upfront financial responsibility.

- Co-pays and Co-insurance: These represent fixed amounts or percentages you contribute towards medical expenses after meeting your deductible.

- Out-of-Pocket Maximum: This is the maximum amount you will pay for covered healthcare services in a year.

Choosing coverage options that align with your financial situation and healthcare needs is crucial for maximizing the value of your health insurance plan.

Conclusion

Understanding cost per pay period health insurance empowers you to effectively manage your healthcare expenses and make informed decisions about your coverage. By breaking down premium costs into manageable figures, budgeting becomes more straightforward, allowing you to allocate funds responsibly while ensuring access to quality healthcare. Remember to consider various factors influencing premium calculations and explore different coverage options to find a plan that best suits your individual needs and financial circumstances.